What Is Opening Balance Equity

What should you do if you come up across a mysterious balance in an business relationship known every bit opening residual equity on the residual sheet while working on massive accounting software?

You lot won't suddenly become to know what needs to exist washed in such scenarios. That is why we are here to aid you lot.

Hither you volition get answers to all your questions related to opening balance disinterestedness.

Table of Contents

- What is opening balance equity?

- What are opening balance and closing balance?

- What is the reason for a big corporeality in the opening residual equity business relationship?

- Understanding remainder sheets

- How to bring an opening residual equity business relationship to nada?

- What are retained earnings?

- What is owner'due south equity?

- Reasons for opening residuum equity

- Mutual mistakes to avoid

- What does negative opening remainder mean?

- What kind of account is an opening rest equity account?

- Determination

- Fundamental Takeaways

What is opening residuum disinterestedness?

Opening balance equity is an account that is created by accounting software and depicts the difference between the debit residual and credit residue in the General Ledger of the business organisation that uses accounting software such as Deskera. It helps to commencement opening residuum transactions. The opening residuum account may not brandish on the balance sail in case the remainder is zero.

What are opening balance and closing remainder?

The amount of money whether positive or negative at the beginning of the accounting period refers to the opening balance of an business relationship. While the corporeality left in an account at the stop of an accounting period refers to the closing residue.

What is the reason for a large amount in the opening balance disinterestedness account?

The master reason for a big amount in the opening remainder equity account is banking concern reconciliation adjustments that were non done properly. Make sure the bank argument balance transaction accounts for uncleared bank checks while completing a bank reconciliation.

Understanding Balance Sheets

If y'all desire to understand opening balance equity in a better mode, it is vital to accept a deep understanding of the balance canvas basics:

A residual canvass is a fiscal statement that helps in tracking the progress of a company and it comprises of three parts: assets, liabilities, and equity.

The residue canvass equation is:

Avails = Liabilities + Equity

In remainder canvass accounts, transactions must cancel out at zero. Thus, if you desire to create a new asset account with a residuum, you demand to balance information technology out past the same amount on the other side of the equation.

For example, if you accept an asset account similar a checking account, and a balance of $50 is added to accounting software, then the other business relationship must be provided $l to make your balance sheet balanced. This is an example of an opening residuum equity account. If you desire to arrange the opening balance of the banking company account, the balance will be prepare to $50 temporarily.

How to bring an opening residual equity account to zero?

You need to make your balance canvass look more professional by clearing out the residual in this account. In that location are various ways by which you can make journal entries to close this account off. Allow's have a look:

- In case your visitor is a corporation: In such cases, you demand to close out the balance equity to "Retained Earnings".

- In case your company is a sole-proprietorship: In such cases, you demand to close out the balance equity to "Owner'south Equity".

- In instance yous find a positive remainder, then you will have to put a debit entry to the opening remainder disinterestedness account and a credit to the owner'southward equity account (or retained earnings account.)

- In instance of a negative residuum, you need to put a credit entry to the opening balance equity account and a debit to the owner'south disinterestedness account (or retained earnings business relationship.)

Note that whether you are closing the rest equity to retained earnings or the possessor's equity, information technology is substantially the same concept. These equity accounts have been labeled differently in order to denote the ownership or form of a business.

What are retained earnings?

Retained earnings refer to the profits earned by a visitor, minus the dividends information technology paid to the shareholders. Basically, they human activity every bit the part of the cumulative turn a profit that is held or retained for future apply. They are reported under the shareholder's equity department of the balance sheet.

Retained Earnings= Kickoff period of RE + Net income (or Loss)- Cash Dividends

What is owner's equity?

Owner's equity refers to the investment of the owner in the business concern minus the owner'due south withdrawals from the concern plus the cyberspace income (or minus the net loss) since the beginning of the business organisation. It can also be considered a source of business assets.

Reasons for opening rest equity

There are several reasons for which an opening balance equity business relationship is created. Let's take a await:

- When you lot want to create a data file for new businesses with kickoff balances, an opening balance disinterestedness account is created.

- When the banking concern and credit cards are added initially with account balances, an opening remainder equity business relationship is created

- When you brand the beginning entry into new accounting software, an opening balance disinterestedness account is created.

- When you lot add together a new item to the chart of accounts including new inventory, so an opening residuum disinterestedness account can be created.

When yous have a new vendor or customer entry with value balances, then you can create an opening residual disinterestedness business relationship.

Mutual mistakes to avoid

In that location are mutual mistakes that people make with their open balance equity accounts. Allow'south accept a look:

An opening balance equity business relationship should be temporary, and non permanent. It should incorporate a residue for merely a significant catamenia of fourth dimension. However, most people put the balance on for an extended menses of time. This is a common error that should be avoided. In case of a lingering residue, information technology tin can atomic number 82 to incorrect bank reconciliation adjustments. That is why an accountant should brand sure that the banking concern reconciliation is adjusted to zero before the completion of the period.

For the correct adjustment procedure, the ending balance should be entered, depository financial institution-cleared items should be marked, so the balance should be reconciled to zero. That is why accountants should sentry for uncleared bank checks. Whenever a company gets office of the cash from loans or other financing facilities, then the accountant should increase the liability on the credit side of the journal entry as this reflects the debt. This should exist washed carefully afterwards analyzing the chances of the loan being repaid within i twelvemonth.

Let'southward take a look at some reasons that cause an opening residue:

- A misunderstood transaction on the opening balance equity account.

- When you fail to deactivate an opening rest equity account.

- Failure to check if the account is inconsistent.

What does negative opening balance hateful?

A negative residue is mostly seen in a checking account when a business has a negative residuum. The negative balance occurs due to issuing checks for meaning amounts of cash, that exceed the amount in the checking account.

What kind of account is an opening balance equity business relationship?

Opening remainder disinterestedness account is located under the disinterestedness department on a balance sheet and is a special account merely used by a computer. Information technology is used to offset other accounts for accounting books to exist counterbalanced.

Conclusion

It is very important for businesses to maintain their financial records properly in order to showcase the true country of the companies. For this, they can seek assistance from accountants who take extensive knowledge regarding opening balance equity. They make certain that the avails of a visitor match its liabilities and equity.

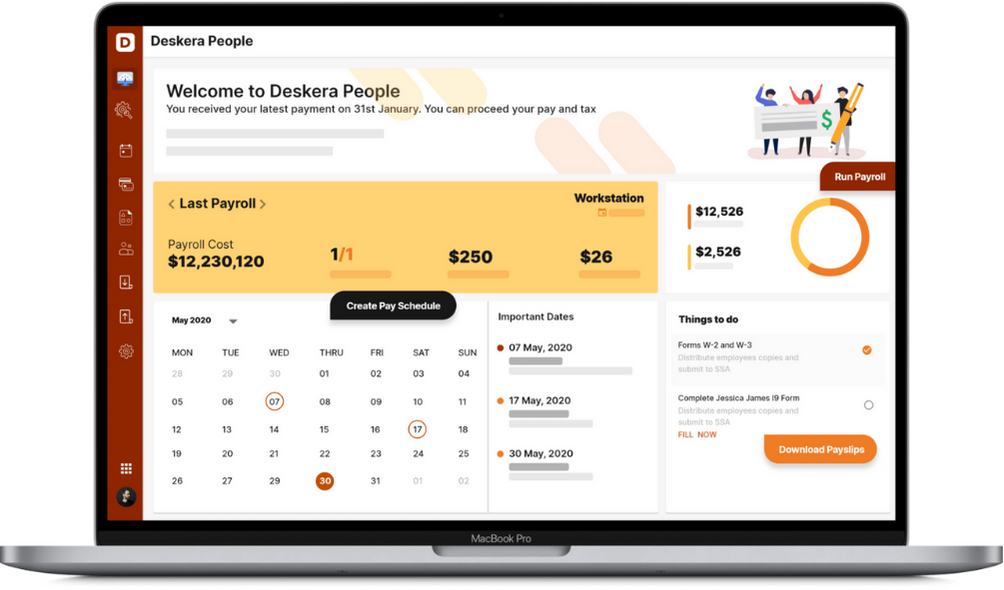

In instance the balances don't match, it can lead to lingering balance, which tin can exist cleaned up using software like Deskera. This software helps you rectify errors causing opening balances, including incorrect banking company reconciliation adjustments, inconsistent entries, mislabelled transactions, and failure to deactivate an opening rest equity account.

How Deskera Tin can Assist You?

As a business, you must exist diligent with the employee payroll system. Deskera People allows you to conveniently manage payroll, exit, attendance, and other expenses. Generating payslips for your employees is now like shooting fish in a barrel as the platform besides digitizes and automates HR processes.

Try Deskera for your Business organisation

Sign upwardly for your Complimentary Trial Today!

Key Takeaways

- Opening residuum disinterestedness is an business relationship that is created by accounting software and depicts the difference between the debit balance and credit balance in the General Ledger of the business that uses accounting software such as Deskera

- The main reason for a large amount in the opening balance disinterestedness account is depository financial institution reconciliation adjustments that were not done properly

- A residual sheet is a financial statement that helps in tracking the progress of a company. It consists of three parts: assets, liabilities, and equity

- It is very important to bring an opening balance equity account to cipher in club to make your account wait more professional person

- Retained earnings refer to the profits earned by a company, minus the dividends information technology paid to the shareholders

- Owner'south equity refers to the investment of the owner in the business minus the possessor'due south withdrawals from the business organization plus the net income (or minus the internet loss) since the beginning of the business

- At that place are various reasons for creating an opening balance equity account including creating a data file for new business, adding banking concern and credit cards initially with account balances, making the first entry into new accounting software, or having a new vendor or customer entry with value balances, etc.

- There are some common mistakes related to an opening remainder disinterestedness account that should be avoided

- Well-nigh people put a residuum in an opening remainder equity account for an extended menstruum of time. This is a mutual mistake that should be avoided

- A negative opening balance indicates that an incorrect accounting transaction has occurred which means that debits and credits were accidentally reversed or the wrong business relationship has been used for the journal entry

Related Articles

How Does Open up Enrollment Piece of work?

Because of a special enrollment period (SEP) in early 2021, open up enrollment hasreached its highest level since the Affordable Care Act prepare health insuranceexchanges in 2013, when they were beginning prepare. CMS says that 13.six million people have signed up for health insurance throughHealthCare.go…

Discussing Salaries with Coworkers

Have you ever wondered if you're beingness appropriately compensated, or what otheremployees in your firm make? Although employers aim to exist more open and honest,everyone has different feelings about talking about salaries with coworkers andhow much data they're comfortable revealing. Keep in…

v Most Effective Ways to Conquer the Admin Tasks for 60 minutes Professionals!

Did y'all ever wonder how your business tickets and other role tasks were alwaysseamless? For a busy professional person, the administrative duties are done past the HRdepartment ofttimes go unnoticed as he is always involved with the projects to meettheir corresponding deadlines. If you are an employer, the …

What is an Employer Identification Number (EIN)?

Could it be the aforementioned as Tax ID or Tax Registration Number for Us Companies? Employer Identification Number (EIN) is also known as Tax ID or Tax RegistrationNumber. The IRS of USA issues to any business organization entity including SoleProprietorship [https://www.deskera.com/blog/sole-proprietorship-taxes/],…

What Is Opening Balance Equity,

Source: https://www.deskera.com/blog/opening-balance-equity/

Posted by: landagics1980.blogspot.com

0 Response to "What Is Opening Balance Equity"

Post a Comment